Doc Searls wrote an interesting article regarding Apple’s upcoming content blocking in iOS 9. The main message seems to be that content blocking is good and will make the web better for the people. I admire his ability to take a strong position for content blocking. While I tend to agree that “tracking is spooky” I’m not quite so sure blocking is the right way to go.

He makes a difference between good and bad advertisement (Wheat and Chaff). The separation is not realistic in this context. If you block ads, you’ll block all ads and become a free rider. From a website operator’s perspective this means that one scalable revenue source goes away. In practical terms:

- Don’t develop your website/product unless you can do so as a hobby. That is, sacrifice the user experience?

- Have access to capital, at least until you have enough paying customers / readers / users. Sacrifice independence?

- Make ads that don’t get blocked. Sacrifice integrity?

It would be technically possible to block only the “tracking” part of ads business. Apple is not doing so presumably because blocking everything forces websites into Apple’s ecosystem as publishers or app developers.

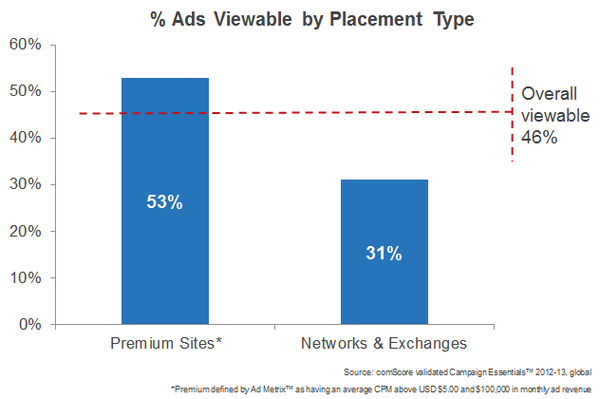

Generally, ad targeting is good. The viewer is happy to see a meaningful ad and the advertiser is happy because their ad budget was not wasted. In a perfect world everyone would win. Doc Searls differentiates tracking-based ads and brand advertising. It’s worth noting that also brand advertising can be targeted by choosing the right media: e.g. advertise sports shoes in sports media. Tracking has been a way to “extend” the media so that an advertiser has been able to show sports shoes ads outside sports media by tracking the viewer from the sports context. Maybe this has real privacy implications?

A huge part of the web relies on advertising as the primary source of revenue.

A huge part of the web relies on advertising as the primary source of revenue.

eresting fiction to read during the christmas holidays. As a surprise to myself, I ended up reading science fiction. I came by

eresting fiction to read during the christmas holidays. As a surprise to myself, I ended up reading science fiction. I came by

I read a 1981 marketing classic by Ries and Trout: “

I read a 1981 marketing classic by Ries and Trout: “